Leggi l’originale su Business Insider.

L’avvento dei “Robo-consulenti finanziari” può sembrare un fenomeno minoritario, eppure il rateo di crescita sembra esponenziale. Business Insider analizza il fenomeno, a partire da un evento molto vicino a noi: l’apertura di un “temporary shop” a Milano.

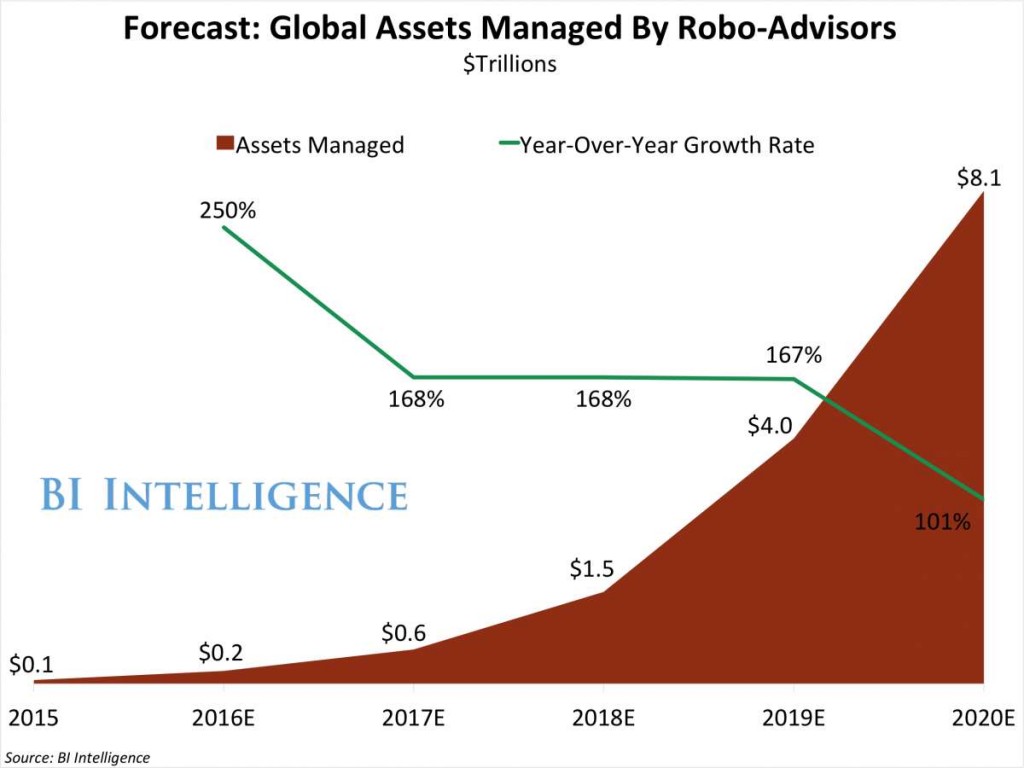

Che sia un trend destinato davvero a seguire il forecast (arrivare a 8 trilioni di dollari di AUM entro il 2020), oppure a crollare, una cosa è certa: siamo entrati nel periodo di più grande cambiamento nei mercati finanziari da quando, negli anni ’70, furono introdotti i fondi Index, i bancomat ed il brokeraggio “economico”.

Che sia un trend destinato davvero a seguire il forecast (arrivare a 8 trilioni di dollari di AUM entro il 2020), oppure a crollare, una cosa è certa: siamo entrati nel periodo di più grande cambiamento nei mercati finanziari da quando, negli anni ’70, furono introdotti i fondi Index, i bancomat ed il brokeraggio “economico”.

D’altra parte è già capitato in varie parti del settore:

- Banche tradizionali vs. banche online – con la conseguente commoditizzazione della maggior parte dei servizi che precedentemente erano “a canone”

- Prestiti tramite società di credito vs. microcredito e crowdfunding – fenomeni che spostano l’accesso al credito dal Credit Rating all’appeal di mercato dell’idea imprenditoriale

- Asset management tradizionale vs. “robotizzato” – la nuova frontiera, con i nuovi consulenti finanziari che sembrano in grado di competere con i “big player” (che si stanno di conseguenza attrezzando per contrastarli, da .

Un settore già scosso dalle recenti turbolenze di mercato rischia dunque di essere ulteriormente rivoluzionato dall’automatizzazione di quella che è da sempre stata un’attività profondamente umana: la comprensione del profilo e delle esigenze del cliente, e la conseguente one di una soluzione su misura.

Davvero è possibile che degli algoritmi possano sostituire le reti di promozione e vendita finanziaria? Oggi più che mai, il consulente finanziario si deve evolvere, per stare un passo davanti alle macchine

Robo-advisor MoneyFarm has taken an unusual approach, but it could prove rather effective in the long run.

The company, which provides automated investment advice to users in the U.K. and Italy, has opened up a pop-up shop in Milan, reports Finextra. The temporary establishment will let potential customers view a demo of the company’s app, create a sample investment portfolio, and consult with a financial advisor.

The store will also entice customers with free events such as wine tastings, coding classes for children, and breakfast sessions with financial news reviews.

The pop-up shop opened on May 20 and will remain open until July 6 in Milan, at which point it will move to London.

Robo-advisors must scale in order to succeed because their business models depend on working with a significant number of assets. The roadblock, though, is that consumers might be hesitant to make the transition from a human financial advisor to a robo-advisor. But a successful marketing campaign can help with this transition.

Customer acquisition costs for robo-advisors can be high, in the range of $300 to $1,000 per person. To compensate for this, robo-advisors are bringing in new customers through partnerships. U.S. firm SigFig, for example, has partnered with multiple legacy wealth managers and now claims that it has no acquisition costs whatsoever.

The rise of robo-advisors shows that we’ve entered the most profound era of change for financial services companies since the 1970s brought us index mutual funds, discount brokers and ATMs.

No firm is immune from the coming disruption and every company must have a strategy to harness the powerful advantages of the new fintech revolution.

The battle already underway will create surprising winners and stunned losers among some of the most powerful names in the financial world: The most contentious conflicts (and partnerships) will be between startups that are completely reengineering decades-old practices, traditional power players who are furiously trying to adapt with their own innovations, and total disruption of established technology & processes:

- Traditional Retail Banks vs. Online-Only Banks: Traditional retail banks provide a valuable service, but online-only banks can offer many of the same services with higher rates and lower fees

- Traditional Lenders vs. Peer-to-Peer Marketplaces: P2P lending marketplaces are growing much faster than traditional lenders—only time will tell if the banks strategy of creating their own small loan networks will be successful

- Traditional Asset Managers vs. Robo-Advisors: Robo-advisors like Betterment offer lower fees, lower minimums and solid returns to investors, but the much larger traditional asset managers are creating their own robo-products while providing the kind of handholding that high net worth clients are willing to pay handsomely for.

As you can see, this very fluid environment is creating winners and losers before your eyes…and it’s also creating the potential for new cost savings or growth opportunities for both you and your company.

After months of researching and reporting this important trend, Evan Bakker, research analyst for BI Intelligence, Business Insider’s premium research service, has put together an essential report on the fintech ecosystem that explains the new landscape, identifies the ripest areas for disruption, and highlights the some of the most exciting new companies. These new players have the potential to become the next Visa, Paypal or Charles Schwab because they have the potential to transform important areas of the financial services industry like:

- Retail banking

- Lending and Financing

- Payments and Transfers

- Wealth and Asset Management

- Markets and Exchanges

- Insurance

- Blockchain Transactions

If you work in any of these sectors, it’s important for you to understand how the fintech revolution will change your business and possibly even your career. And if you’re employed in any part of the digital economy, you’ll want to know how you can exploit these new technologies to make your employer more efficient, flexible and profitable.

Scrivi un commento

You must be logged in to post a comment.